single life annuity with cash refund

Single or joint life. By continuing payments to a beneficiary for a certain.

Qlacs Life Only Or Life With Cash Refund Annuityfyi Com

Annuities are often complex retirement investment products.

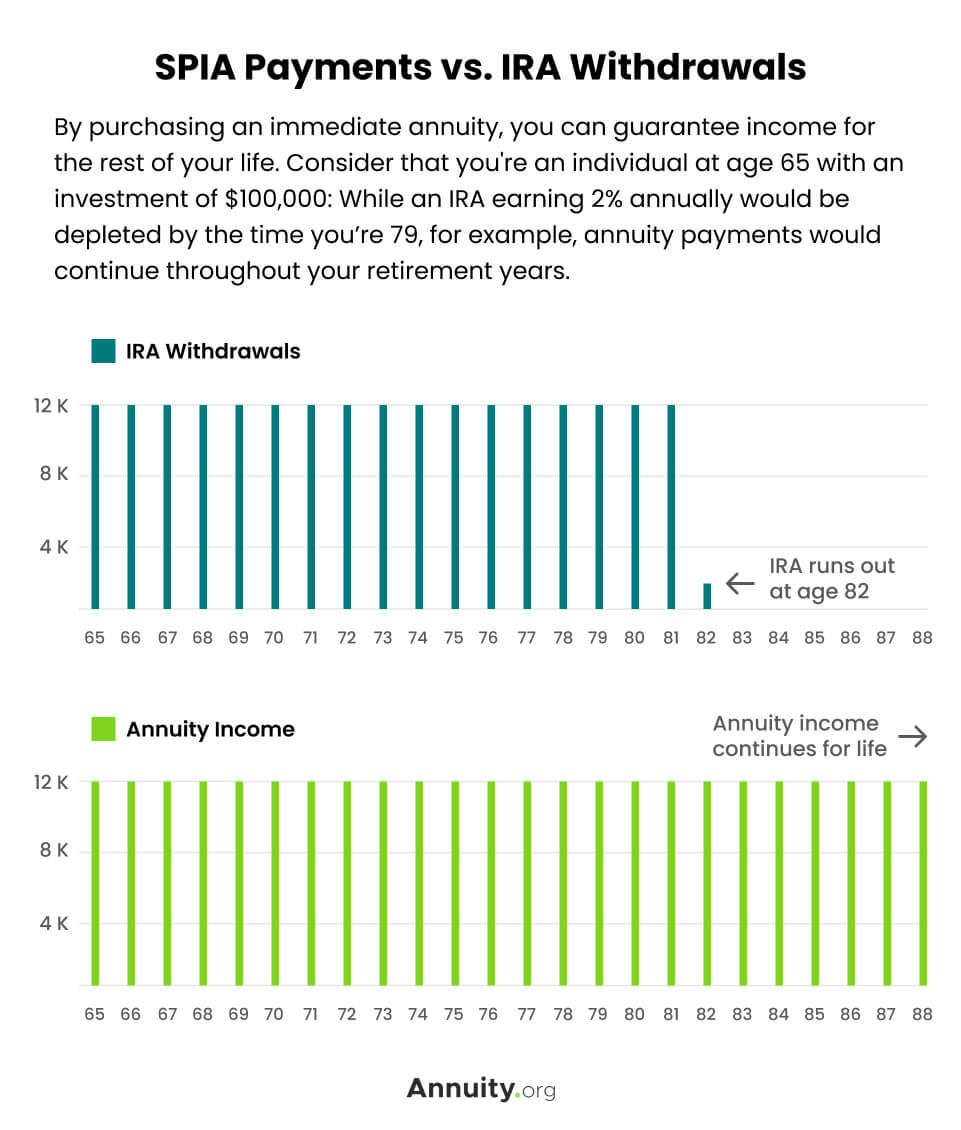

. The advantage of the single life annuity is that for as long as youre living you will receive a higher monthly amount than you would have been paid from a joint annuity which covered your wife. Theres a myriad of ways to structure immediate annuities. A single premium immediate annuity SPIA is purchased with a lump sum and starts paying out periodic income payments almost immediately or within the year.

A Cash Refund Feature Now Optional with INPRS Participants when Purchasing Annuities from MetLife. The excess sum carries on as. The single life annuity does not provide a death benefit.

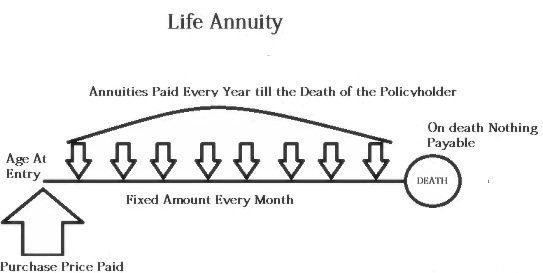

Payments stop when the annuitant dies. It stops paying after your death. Annuitants for a Joint Life policy were to live beyond that period payments would continue for the lifetimes of the annuitants.

Learn some startling facts. Joint life annuity A joint life annuity provides a monthly. Life with Cash Refund.

A single-life with cash refund annuity is an annuity that is based on one persons life. If one or both were to die prior to the end of the guaranteed. A premature death reduces the value of a single life annuity because payments end with the annuity holders death.

Single Life with Cash Refund. The monthly income will continue for as long as this person is alive. Single life annuity A single life annuity provides a monthly amount only to you for as long as you live.

A single-life with cash refund annuity is an annuity that is based on one persons life. Haithcock prefers to call it the life with balance refund option because any remaining account balance is paid out to. Life with cash refund is the most popular option chosen with QLACs.

Pays income for one lifetime and the lifetime of one other person if joint life. For example under a Single Premium Immediate Annuity SPIA an individual may choose to structure their annuity as life with a cash refund or joint-life with a cash refund. Single Life Annuity means an annuity providing equal monthly payments for the lifetime of the Member with no survivor benefits.

For example if the owner paid in 50000 and dies after. One popular option to. SINGLE LIFE This option also referred to as life only provides guaranteed income for life.

But today lets talk about single life annuity with cash refund what it means how it works and. If they die before. By definition a cash refund annuity is a contract that forks over the remaining cost basis to a beneficiary when the owner dies.

Ad Learn More about How Annuities Work from Fidelity. Compare Live Annuity Rates From Over 25 Top Rated Companies. If the annuitant dies before their original investment has been paid out that.

The monthly income will continue for as long as this person is alive. Single life annuity customers who hold quick annuity normally begin getting installments inside the first year of the annuity understanding. Lifetime with Cash Refund Refund Annuity The annuitant will receive payments for the rest of their life until the day they die.

Cash refund annuities cashable annuities or principle protection all mean the same thing. In my case a 50 joint annuity cost me a hit of about 1 relative to the. If they die before.

Cash refund annuities are an answer to the increasing demand for flexibility along with the security. Ad Get The Most Income. Ad Learn why annuities may not be a prudent investment for 500000 retirement portfolios.

Also check out the single vs. In a life with a cash refund annuity payments are made until the annuitant dies. Cash refund annuity also known as cash back cashable lump sum refund annuity cash refund guarantee or Principal Protection provides another solution for retirement income planning that.

Single Life Annuity. Additionally this option guarantees that if the annuitants die the. Life with Installment Refund provides the highest lifetime income guarantee while also contractually assuring that 100 of the initial remaining premium goes to someone.

Ad Learn More about How Annuities Work from Fidelity. A refund life annuity is a life annuity with a rider tacked on that refunds any amount remaining to your beneficiary should you pass away before receiving the full amount. Special Hazard Loss Coverage Amount With respect to the.

If the annuitant you dies before receiving your original. Starting July 1 2021 retiring members of the INPRSs defined contribution plans may.

Straight Life Annuity Discover How It Works What You Need To Know Wealth Nation

Lifetime Income With Cash Refund The Annuity Expert

Lifetime Income With Cash Refund The Annuity Expert

Single Premium Immediate Annuity Spia Rates Pros Cons

Single Life Annuity What Is A Single Life Annuity Lifeannuities Com

The Cash Refund Annuity Pros And Cons 2022

Learn The Difference Between Life With Installment Refund And Cash Refund Stan The Annuity Man

How A Cash Refund Annuity Works Smartasset

New York Life Annuity Guaranteed Future Income Annuity Ii

Understanding The Tsp Life Annuity Withdrawal Option Part Ii

Understanding The Tsp Life Annuity Withdrawal Option Part Ii

Lifetime Income With Cash Refund The Annuity Expert

Learn The Difference Between Life With Installment Refund And Cash Refund Stan The Annuity Man

Understanding The Tsp Life Annuity Withdrawal Option Part Ii

Understanding The Tsp Life Annuity Withdrawal Option Part Ii